Pharma is in Deep, Deep Trouble

I spoke with someone at a top 10 Pharma company yesterday. Like many companies, they have restructured – again – and in their latest restructure, they have moved many management positions offshore to low-wage countries to save money. He said this looks like the first group of functions to be moved but they indicated that more will follow. If they don’t move, they are made redundant.

We all know of the numerous and repeated job cuts most Pharma make year upon year. Now jobs are just being moved to low-wage countries as an extra step to save money, yet every day I read about amazing, interesting health-related innovations on the Eularis Twitter feeds…

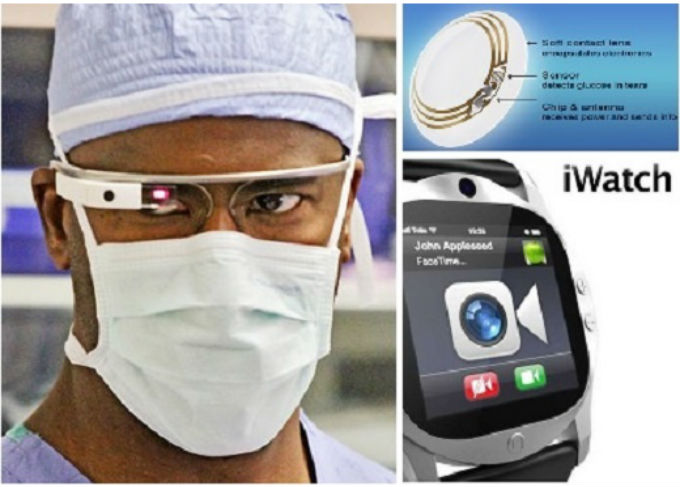

‘Glasses to assist surgeons to know everything about a patient while they are operating, as well as allowing other surgeons to assist remotely and place their hands virtually on a patient to show the surgeon operating their advice when needed’, ‘Contact lenses that measure blood glucose in the tears’, ‘The iWatch and what we expect it will contain’, etc.

Amazing stuff!

But where is Pharma on this list? One of our Tweets was about the war between Apple and Google to own the health space. Look at health wearables – worth $500 billion in the next 5 years alone. Again – where is Pharma? Should Pharma not be at the forefront of all this?

Pharma is Being Out-Innovated

What is Pharma doing instead?

- Organizational restructuring and downsizing to protect declining EBIT margins (In fact, a report by the Institute for Policy Studies in 2012 reported that 119,000 Pharmaceutical jobs have been lost since 2008. That was 2 years ago and the downsizing continues)

- M&A activity to fill pipeline and portfolio gaps, and to generate economies of scale

- Shifting key operations such as R&D, production, etc. to countries with lower labor costs

- Attempts to increase R&D efficiency

- Diversifying into adjacent areas such as generics, nutritionals, vision care, surgical equipment and devices, and animal health

- Focusing on discrete segments of the value chain by outsourcing most of the functions that do not add significant value (e.g. manufacturing)

- Expansion into rare diseases/orphan drugs that offer easier market access and higher market exclusivity

Rearranging Deck Chairs?

Now, I am not a Pharma CEO but from where I stand, this looks like rearranging the deck chairs on the Titanic. These are all obvious, sensible things to do in a short-term crisis but really, we are beyond a short-term crisis now.

We are the laggards. Google and Apple are not simply cutting jobs and costs and shifting their people to India. They are looking at the health market and saying: ‘Well, health wearables alone are $500 billion – let’s get that”, “Diabetes is a massive market – let’s make sure all our wearables have a glucose monitor on them”. They are thinking proactively, not reactively.

The Pharma approach reminds me of a World Cup game I watched. The first half of the game the one team was being reactive, just trying to defend and stay in the game. But then in the second half, something shifted and they were playing proactively and started scoring, not just trying to defend but actually really playing the game. It reminded me of Pharma, as today’s industry is playing a purely reactive game.

We need to reinvent ourselves into a ‘Health’ company not just a ‘Drug’ company. I know there are challenges to reinventing ourselves for real growth – changing the existing business model and company culture, a serious lack of senior management support, the whole mindset of a cost center rather than an investment, integration of solutions versus products, blaming the environment and regulators, poor analytics, and so on.

Pharma’s Competitive Edge

Remember that Pharma also has many things that give us a competitive edge over Apple and Google. We know the sector, we know the key players, and we have the drugs. Furthermore, if the job cuts start slow down, we have intelligent people too. Why are we not doing this? It just needs some serious thought and some analytics, then follow-through and commitment from senior executives.

Everyone pays lip service to value beyond the pill. There is talk of customer centricity, networks and partnerships, outcomes focus and added services.

Great! And to be fair, there are ‘some’ good things going on in Pharma. We have recently been working on some market access analytics for a Pharma client in the US to understand the real drivers for both payers and patients – and this client gets it.

They are planning amazing hubs of bundled services around the drugs that really work for the payers’ real underlying drivers as well as the patients’ underlying drivers. They are not just paying lip service. Even though they are a relatively new private player, they have grown dramatically, well into the billions recently, and we can see why. But I feel this is not the norm – not from what we’re seeing.

Conclusion

But more on this in Part II.

Found this article interesting?

To learn more about how Eularis can help you find the best solutions to the challenges faced by healthcare teams, please drop us a note or email the author at abates@eularis.com.