Healthcare is changing at an unprecedented rate. Exciting new technologies and techniques have opened the door to a host of novel medical interventions and approaches. A greater emphasis on patient outcomes, expanded access and greater affordability, combined with advances in artificial intelligence (AI) and big data and shifting customer expectations, have seeded a perfect storm in the world of healthcare and pharmaceuticals. Navigating it will require radical and far-reaching change from the pharmaceutical industry—something it’s been historically slow to accomplish.

Evidence of this is ubiquitous.. Studies reveal that a majority of CEOs believe the number one factor driving revenue growth is new products. But while pharma continues to invest heavily in R&D, the results aren’t as impressive as one would hope: just 30-40 new drug approvals each year. In addition, according to Nielsen BASES, 93% of all new products fail within the first three years; and line-extensions fare even worse. Overall, returns on investments in R&D have been steadily declining for the last 30 years. Clearly, the answers are not here.

Past problems related to declining R&D productivity, shrinking pipelines, and pushback from payers have been staved off through aggressive M&A schemes, soaring prices, moderately performative line extensions, patents (expiring today in ever greater numbers), and pharma’s “too-big-to-fail” Blockbuster business model. But these tactics are no longer working. Yesterday’s solutions can no longer sustain us to thrive in the coming decade.

If this sounds familiar, it should. Concerns about current business models were raised as early as the turn of the millennium, when it was already becoming obvious that trouble was on the horizon.

While pharma has been slow to respond to such calls for change, the tech industry has not-so-quietly been making its debut in the world of healthcare, with astonishing and exciting—or alarming, depending on your perspective—results. The entry of fast-moving new tech actors, armed with extraordinary amounts of data and already used to leveraging AI to its full potential, is shifting medical targets from treatment to prevention and curative therapies, earlier diagnoses (often reducing the need for medication as the condition is caught early) , digital therapies (DTx) sometimes eliminating the need for medicines completely, and tech solutions to replace drugs (e.g. nanobots).

Unsurprisingly, the areas susceptible to the greatest impact from these disruptions are precisely those which have held pharma’s attention (and funded its activities) for the last several decades, namely oncology, diabetes, chronic conditions, and rare diseases.

It’s not “business as usual” anymore

Healthcare is the largest sector in the world, three times larger than banking. But it lags behind in innovation, in spite of cutting-edge medical breakthroughs. If this lack of innovation is not a result of slowing technology—which it most certainly is not—then where does it come from? The answer is an antiquated, no longer relevant business model.

In the past, value came from new, cutting-edge, effective medicines, discovered, developed, manufactured, marketed, and sold by pharma. But pharma companies are no longer alone. Google, armed with huge amounts of data and AI has already entered the pharma business focused initially on drugs for the aging. FujiFilm, once a rival of Kodak, is now in the pharma business, with $981 million in pharma sales predicted by 2024 and plans to construct the largest biopharmaceutical CDMO facility in North America (a $2 billion investment), offering end-to-end biologics production to incumbents and newcomers alike. It is one of many historically non-pharma businesses making the shift.

Pharma doesn’t have the monopoly it once had, and the sector is ripe for disruption. But pharma companies continue to act as if new medicines – albeit personalized gene therapy type medicines – will save them. But if patients are caught early te requirement for many of the drug or gene treatments will be reduced significantly. This kind of short-term thinking around medicines being the future is demonstrated by the fact that more is spent on share buybacks than R&D and a symptom of boards’ tendencies to focus on the next quarter and immediate shareholder value. The truth is, pharma’s obsession with drugs has blinded it to the truth of what really matters: its customers as customers, and not as auxiliary spokes on the wheel that spins around the pill.

In addition, important changes in the healthcare arena beyond the administration of drugs are poised to have a profound impact on the pharmaceutical market. Recent advances in the diagnosis and treatment of oncology speak to this.

Cancer diagnoses are historically difficult. Many of the largest “red flag” symptoms have nonetheless relatively low predictive value, and “silent killers” like pancreatic, non-small cell lung, ovarian, sarcoma, kidney, and brain cancer abound. Symptoms are often a sign of an advanced stage and not an early warning system.

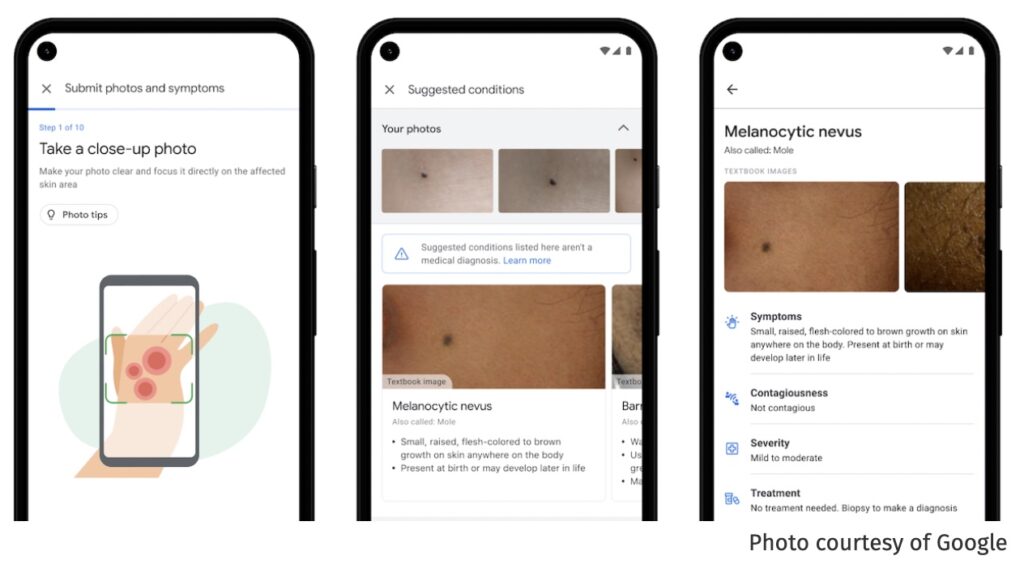

New technology and perspectives promise to change that. For example, Google’s Dermatology AI leverages deep learning to offer rapid, early diagnoses that are “non-inferior or superior” to dermatologists, primary care physicians and nurses. Other tech start-ups are likewise using AI to offer earlier, more accurate diagnoses. Smart homes now offer diagnostic tools built into mirrors and toilets to catch cancer, diabetes, and other chronic conditions early on.

What has this got to do with pharma? The result of all this is that individuals will be diagnosed earlier and treated prior to developing full-blown conditions, thus reducing the drug market significantly.

Wearables and smart devices are being used in cancer treatment to equal effect. Digital therapies have started to replace traditional molecules and are just as effective in clinical trials—without the side effects. Companies like Medtronic are inventing digestible pill cameras to provide images from inside the body, and it’s not so great a stretch to imagine their use for trating conditions without the need for drugs. Nanobots are already being used to clean out cholesterol, and could equally be adapted for tumour biopsies, or even advanced, targeted treatments.

The danger to pharma from earlier diagnosis, DTx, and nanobots, is that they preclude or exclude the need for traditional drugs. Molecules have their place in the future of medicine, but they are no longer the future of medicine. Business models that treat them as such are doomed to fail.

Traditional therapies are not dead, but they are taking on a new smaller role, in a new arena driven by advances in technology, and especially AI and big data.

To stay relevant, pharmaceutical companies, their executives and marketers, need a stronger understanding of their customers—their needs, their expectations, and how these drive behavior—and most importantly, of how to market to those needs and expectations efficiently and effectively.

Given the current, shifting environment, “business as usual” is no longer a viable solution, and sticking to old models has proven deadly in other arenas where tech has made its entry: Blockbuster, Kodak, Borders—the list is long. Google and Amazon are already making headway into the pharma space, and Silicon Valley investments in healthcare AI and tech now beat out every other sector.

The way forward

With pay-per-pill business models breaking down in favor of pay-for-performance and pay-for-value pricing, even greater financial turbulence is on the horizon and fast approaching. To survive, pharma must consider other options. There is no shortage of successful business models to choose from:

● Subscription (Netflix, Forward)

● Freemium (Dropbox, LinkedIn)

● Free-for-Consumer (Google, Facebook)

● Marketplace (eBay, Uber, Airbnb)

● Access-over-Ownership (Airbnb, Zipcar)

● Hypermarket (Amazon)

● Experience (Apple, Tesla)

● Pyramid (Microsoft)

● On-Demand (Uber, TaskRabbit)

● Ecosystem (Google, Apple)

Two of these stand out as particularly sensible for pharma: Subscription and Ecosystem.

Subscribe to thrive

A multitude of health-focused, disruptive companies are using a subscription model. Forward is a Google-funded start-up that operates a wellness clinic similar to a high-end gym. Users pay $149 per month and receive unlimited access to genetic and blood testing, weight loss planning, doctor visits, and more. Many argue Forward won’t work because health insurers aren’t behind it—but it’s raised more than $100 million and is opening clinics around the United States, so the jury is still out. For those who can afford it, there are obvious advantages. And the savings to everyday subscribers by way of early detection of otherwise costly (not to mention fatal or crippling) diseases may well be worth a modest $1788 per year. Compare that to costs for the management of advanced stages of most chronic diseases in the United States, and it’s a downright bargain.

Push Doctor in the UK is another prime example. Subscribers are able to see an NHS doctor within six minutes, via an online app (its success hints at the benefits of another business model, namely on-demand healthcare). It costs just £20 per month, a fee its users are willing to pay to avoid long, frustrating waits at the doctor’s office. Several ventures of this type have also appeared in the US, such as HealthTap, which costs $99 per month (although so far, no insurance covers it).

These new, no-wait, instant physician models greatly improve the customer experience and are likely to boost health outcomes besides. Plus, they are mostly self-pay, thus reducing the economic burden on healthcare payers and the industry as a whole.

Ecosystems: from drugs to solving problems

Ecosystem models like those employed by Google and Apple also hold enormous promise for pharma. From this perspective, drugs are simply one part of a larger ecosystem, the way search is one part of Google’s ecosystem, funded through other services. As for Apple, its products work together seamlessly, resulting in astounding brand loyalty (iPhone users are far more likely to buy within its ecosystem than not).

This kind of business model fits in perfectly with “beyond-the-pill” solutions. And indeed, wellness and chronic disease management programs have been part of pharma’s armamentarium for years—but not in a money-making sense, not as a new business model, merely as auxiliary services. They play a supporting rather than main role.

With wearables, ingestibles, and implantables offering huge opportunities for pharma companies to get involved in the health of their customers (and to gain a far greater understanding of how their medicines are working), it’s only a matter of time until we see medications coming out with an accompanying mobile app and device to track their outcome.

A health platform ahead of its time, Cue was introduced to the market in 2010. It’s a unique diagnostic system, pocket-sized and accurate to 97.8%. One need only insert a pinprick of blood or a drop of urine or saliva, and Cue is able to diagnose a range of medical issues. It then connects to your physician, pharmacy, and schedule to make the process of diagnosis and treatment seamless. Updates to firmware and software—as new diagnoses are added— serve to increase its value. And as user data explodes and is collected, diagnoses will only become more refined and more accurate, as well as being made earlier. Armed with FDA approval, it is, in short, an impressive little tool that represents many of the promises of modern medicine.

How much longer until companies like Google and Apple, with existing sensors on their fabulously successful devices (100 million Apple Watch users and counting), come out with something similar? No doubt it is already in the works. Integrating this kind of technology into our everyday wearables, phones, and environments, into our everyday lives, makes so much sense it’s inevitable.

Owning the disease

“Owning a disease” is another business model that’s received attention in recent years. Owning a disease refers to using “interoperable devices, real-time integrated data, imbedded intelligence within an engaged social community to support patient behavioral change and improve outcomes” and “focusing not on the episode of care but on the entire patient interaction suite: preventative health and wellness; diagnostics; devices; therapies; post-treatment processes; chronic disease management; and even structures for patient interaction and education” (emphasis added).

This is a model that propelled IBM to the top of the tech game in the early 1980s. Rather than focusing on providing components and hardware, IBM became a leading provider of business solutions—which, after all, is what any customer is really looking for. In the words of IBM’s former chairman and CEO, George F. Colony, “IBM is not a technology company, but a company solving business problems using technology.”

Likewise, pharma companies must shed their skins and move from being “drug companies” to “companies that solve healthcare problems using medical technology.” Owning a disease is one way to do this—creating a platform that integrates preventative care, diagnosis, treatment, and management.

Novo Nordisk: Owning Diabetes

Boards looking for inspiration need only check in with their most successful competitors. Moving from value-chain activities and selling products to a platform featuring third-party providers and value-added services is a clever approach to building a valuable platform ecosystem model and creating additional value for its customers, who buy into the platform and are rewarded with an entire ecosystem of solutions.

Platforms ecosystems are harder to disrupt than the traditional drug-based model. Bolstered by the network effects of a complex web of resources and actors, they are not based on a single, easily knocked down pillar. They resemble more the broad base of a pyramid, resistant to shocks and strains.

Novo Nordisk offers an example. A leader in diabetes medicine, it is now empowering people living with diabetes, and the healthcare practitioners that support them, to connect with tools, services, and programs making their life easier.

Over the past year, Novo Nordisk has partnered with five of the top glucose monitoring companies, engaging in non-exclusive data exchanges with its smart insulin pens for improved treatments and outcomes. This represents a clear shift away from a drug-centric to a customer-centric business model. The addition of AI to its pens allows for the automatic tracking of insulin dosing data, while dosing history can be securely transferred via Near Field Communications (NFC) to a compatible smartphone app. This is only one aspect of their changing business mode. They have also created a platform ecosystem also features Digital Therapeutic solutions, enabling “people with diabetes … to decide which solution works best for them.” Novo Nordisk hasn’t abandoned the sale of drugs; it has simply interwoven them with an AI-powered ecosystem that puts the diabetes customer experience front and center. No matter what product the customer uses, they are using Novo Nordisk’s platform.

The customer is always right

A transformation is waiting to happen in pharma, and steps are already being taken as focus is shifted to better clinical outcomes and value. But an important gap still exists between where we need to go and where we are now. Change must come from the business side of things, with a shift in focus from medicines to customers as people.

As other industries have done, pharma can only solve this problem by becoming data-driven with regards to customers and not just medical breakthroughs and pipelines. In theory, this should be relatively easy for an industry that’s used to dealing with data points and statistics. The missing pieces are investments and tools for collecting user data and the implementation of the technology (i.e., AI and big data) necessary to gain insights. In other words, a genuine transformation is needed in thinking and approach, not just in operations.

Patient participation in healthcare, embodied by what has been called the “genome generation” and the widespread adoption of wearables paired with better sensors and more sophisticated on-device AI, offers a huge number of opportunities to understand customers in a holistic manner. Analyzing, understanding, and predicting solutions that offer real value to customers will enable pharma to deliver comprehensive healthcare solutions based on needs and expectations as they shift (something it has largely failed to do today).

Most of the “beyond-the-pill” strategies Eularis has been involved in—patient engagement, next-best-action modeling in multi-channel and omni-channel strategies, sensors combined with patient data to predict patient-specific lack of adherence, and more—are innovative, but not transformative vis-à-vis business models. They do not shift away from traditional business models but merely work around them, and this can only go so far.

Pharma must keep up with innovation and the latest thinking, tools, and technology, centered around its customers (and not its own products) to evolve sustainable, long-term business models, and not just services and new ways of doing the same thing.

The good gets better

In addition to being inherently customer-centric and opening the door to novel revenue streams, the business models explored above provide additional advantages.

Patient adherence

Non-adherence, particularly for long-term conditions, costs the pharma industry an estimated $600 billion per year, representing a huge loss to pharma companies that have spent millions of dollars in marketing to achieve initial prescriptions. The human cost is staggering, as well. The World Health Organization (WHO) estimates nonadherence rates at roughly 50% for chronic diseases, resulting in worsened conditions, increased comorbidity, and death.

A variety of compliance and adherence programs have been conceived by brand marketers to deal with this. But unless they evaluate the underlying causes and bottom-line returns on investment for specific adherence activities, they are doomed to fail. In light of declining sales, stiffer competition, and weaker pipelines, pharma can no longer ignore the obvious value in increasing patient adherence.

New business models can address this pain point in a variety of fashions. “Owning” a disease, as we’ve already seen, enables companies to offer a streamlined therapeutic experience from start to finish, greatly simplifying patients’ clinical journey. Ecosystems offer variety and choice to patients, enabling them to take a more active role in their treatment. And affordable smart devices, powered by AI and big data, are driving digital therapeutic solutions proven to increase adherence, all the more so when they fit into a subscription or ecosystem-based business model.

Chronic disease management and closed-loop monitoring

Many chronic diseases can be successfully managed through behavioral and lifestyle-related changes. As previously mentioned, personalized digital technologies, powered by AI and big data will be key in this regard.

Thanks to monitoring devices armed with AI, able to react to real-time measurements and alert users and practitioners or deliver medications, closed-loop monitoring helps promote early diagnosis of disease, mitigating the effects and progression of chronic conditions and proactively avoiding adverse events and complications. Think of continuous glucose monitoring, with an integrated monitor and insulin pump with the intelligence to administer the right dose at the right time, or an in-body defibrillator that knows when to act and what kind of pulse to administer to maintain optimal heart performance.

Such monitoring can assist in identifying undiagnosed patients—an obvious advantage for the pharma industry—predict risk of disease progression, determine opportunities for improved management of chronic diseases, alert users and healthcare practitioners to potential future issues, and more. In addition, the data collected from users can be used to further improve health risk assessments. This inherently puts the patient first, creating a new model that is less reliant on traditional medicines as the industry’s main source of revenue.

The result: Better patient outcomes

The result of all these approaches is better patient outcomes and a healthier population, which as an industry, is what we’re striving for. The focus, however, must shift to overall enhanced patient outcomes as opposed to medicines (and medicines alone) that only sometimes deliver such outcomes. Medicines are a piece of the puzzle, but pharma needs to start putting together the others, or somebody else will.

Conclusion

Pharma is faced with a considerable challenge. Business models and decades-old practices, firmly ingrained in the daily operations of pharmaceutical companies and in the hearts and minds of its leaders, now threaten it with ruin. Making changes will not be easy, especially given pharma boards’ historical resistance to anything other than traditional models.

But the rewards are considerable. There are untapped benefits for the pharma industry and all its stakeholders, from researchers and managers to practitioners, patients, and payers. Adopting customer-centric, AI-powered business models like ecosystems and subscriptions, and investing in (rather than paying lip-service to) transformation will allow innovators and early adopters in pharma to reap the benefits and future-proof their company for decades to come.

Found this article interesting?

If you’re looking for help on creating a a future proof company to really transform, speak with us.

For more information, contact Dr Andree Bates abates@eularis.com.